First-time homebuyers taking out a home loan understand they make monthly mortgage payments for a set period of time to repay it. But what they might not know is how each monthly payment is divided between the principal and interest they owe.

A process called amortization determines how much each monthly payment is, and how each payment is divided between principal and interest. Understanding amortization helps you grasp how far along you are toward paying off your loan.

Here’s how mortgage amortization works:

- What Is Mortgage Amortization?

- How Does Mortgage Amortization Work?

- Amortization on Fixed-Rate Mortgages

- Amortization on Adjustable-Rate Mortgages

- Amortization on Mortgage Refinancing

- Why Mortgage Amortization Is Important

- Long vs. Short Amortization Schedules

- Changing Your Amortization Schedule

- Amortization FAQ

- The Bottom Line on Amortization

What Is Mortgage Amortization?

By definition, mortgage amortization means that you’re repaying your home loan with equal, scheduled installments. It gives borrowers a steady and affordable way to pay for a home. Most types of mortgages, including conventional loans, are amortized.

“Borrowers can use amortization to their advantage by finding an amortization period that aligns with their budgetary reality and ongoing financial balance,” says David Tuyo II, president and CEO of University Credit Union in Los Angeles. “Instead of having to save up for an extended period of time or to use a massive lump sum payment to buy a home, amortization gives borrowers the ability to purchase a home that they may otherwise not be able to afford.”

How Does Mortgage Amortization Work?

To repay your mortgage, you must pay off the principal you borrowed and the interest that accrues on that amount. Amortization determines a monthly payment that is consistent throughout the entire loan term.

It also determines how much of each payment goes to interest and how much to principal. This ratio changes with every payment, even as the payment amount remains constant.

Early on, most of your monthly payment goes to interest. Over time, you pay less interest and more of the payment is used to reduce the principal. Toward the end of the loan term, most of the payment goes to principal and the balance on your loan decreases more quickly.

Understanding amortization tables

Mortgage lenders use amortization tables to show how much of each payment goes to interest and principal for the life of the loan. Most lenders provide free copies of your amortization schedule.

Here’s an example of an amortization schedule at the start and end of a 30-year fixed-rate mortgage with a $400,000 principal and a 4% interest rate:

Amortization Schedule for $400,000 Mortgage With 30-Year Term and 4% Interest Rate

| Month | Payment | Interest | Principal | Principal Balance | Total Interest Paid |

| 0 | – | – | – | $400,000 | $0 |

| 1 | $1,909.66 | $1,331.41 | $578.25 | $399,421.75 | $1,331.41 |

| 2 | $1,909.66 | $1,329.48 | $580.18 | $398,841.57 | $2,660.89 |

| 3 | $1,909.66 | $1,327.55 | $582.11 | $398,259.46 | $3,988.44 |

| 4 | $1,909.66 | $1,325.61 | $584.05 | $397,675.41 | $5,314.05 |

| 5 | $1,909.66 | $1,323.66 | $586.00 | $397,089.41 | $6,637.71 |

| 6 | $1,909.66 | $1,321.71 | $587.95 | $396,501.46 | $7,959.42 |

| – | – | – | – | – | – |

| 355 | $1,909.66 | $31.51 | $1,878.15 | $9,485.07 | $287,414.83 |

| 356 | $1,909.66 | $25.25 | $1,884.41 | $7,600.66 | $287,440.08 |

| 357 | $1,909.66 | $18.97 | $1,890.69 | $5,709.97 | $287,459.05 |

| 358 | $1,909.66 | $12.67 | $1,896.99 | $3,812.98 | $287,471.72 |

| 359 | $1,909.66 | $6.34 | $1,903.32 | $1,909.66 | $287,478.06 |

| 360 | $1,909.66 | $0 | $1,909.66 | $0 | $287,478.06 |

Understanding amortization charts

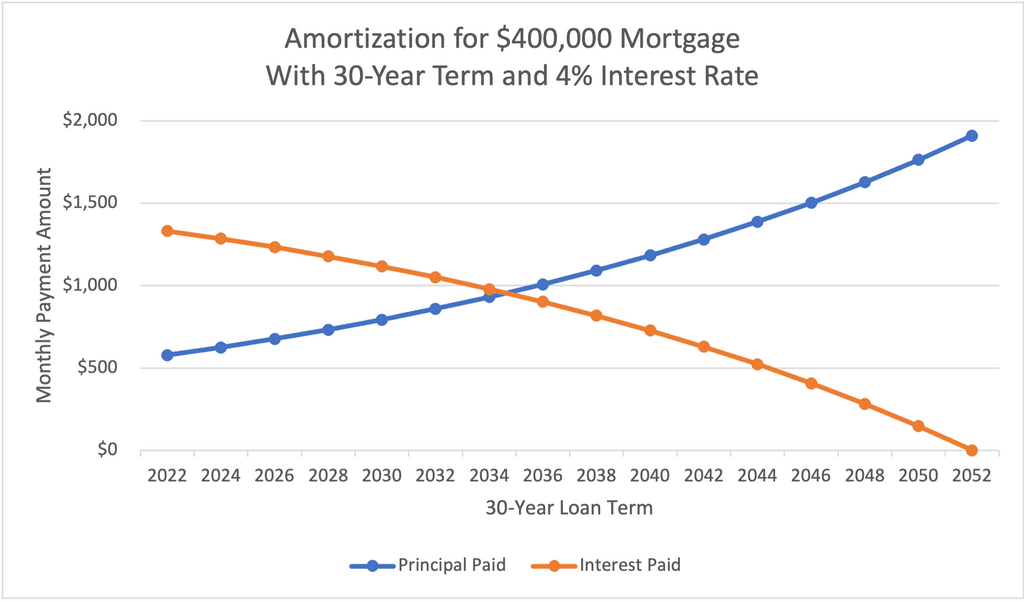

Another way to understand amortization is with a chart showing how the principal and interest portions of your monthly payment adjust over time.

This chart illustrates how you pay mostly interest for the first years of the mortgage, and mostly principal by the end:

In this example, you would make 152 payments — 12 years and 8 months — before more of your payment goes to principal than interest.

Amortization on Fixed-Rate Mortgages

The good news with fixed-rate mortgages is that once you calculate the monthly payment amount, it’s locked in place. Because the interest rate doesn’t change, the payment won’t change, and your amortization schedule can be calculated accurately for the entire loan term.

Amortization on Adjustable-Rate Mortgages

With an ARM, the monthly payment will be recalculated each time the interest rate changes. Over the life of the loan, the amount of each payment that goes to interest will increase and decrease as the interest rate adjusts. The amortization schedule is modified with each interest rate change to keep the loan on track to be paid off at the end of the loan term.

Amortization on Mortgage Refinancing

Loan amortization on a mortgage refinance is no different than on a purchase mortgage. If you change the amount you borrow, the interest rate, or the loan term, it all will be reflected in your new mortgage’s amortization schedule.

Why Mortgage Amortization Is Important

Understanding mortgage amortization helps buyers in several ways:

- Know when to stop paying for private mortgage insurance. The more principal you pay off, the more of the house you own. This is called equity. If you made a down payment of less than 20% of the sale price, and you have a conventional loan, your lender will require you to pay for PMI. Your amortization schedule will tell you when you reach 20% equity, at which point you can ask for PMI to be removed.

- Make financial plans with more confidence. An amortization schedule helps you know the size of your monthly mortgage payment for the life of your loan, allowing you to better plan your finances for the future.

- Keep track of your equity. A mortgage amortization schedule tells you what you can expect your equity to be at any point of the loan. This can help you understand and manage your equity, which you may want to borrow with a home equity loan, a home equity line of credit, or a cash-out refinance.

“You can’t guarantee more income in the future, so you are better off having a stable payment you know you can pay now,” says Lyle Solomon, principal attorney at Oak View Law Group in Auburn, California. “If your circumstances change for the better in the future, refinancing is always an option.”

Long vs. Short Amortization Schedules

Most mortgages are repaid over 15 or 30 years. Deciding between a long or short amortization schedule will depend on your financial situation and goals.

If you can afford a higher monthly payment, a shorter schedule can help you save money on interest and repay your loan sooner. A longer schedule offers a more affordable monthly payment, but you’ll be making those payments longer and paying more in overall interest.

“Borrowers need to find a balance between their income, their expenses, and their debt in order to maintain a healthy financial budget and leverage debt to their advantage,” Tuyo says.

Long vs. short amortization schedule pros and cons

Here are some benefits and drawbacks to each type of amortization schedule:

Long vs. Short Amortization Schedules

| Long Amortization Schedule | Short Amortization Schedule | |

| Pros | – Lower monthly payments can be easier to fit into your budget. – You have less money tied up in an illiquid asset. | – You pay off your loan faster. – You build equity and own your home in full sooner. |

| Cons | – You remain in debt for longer. – You pay more interest overall. | – You’ll have higher monthly mortgage payments. – You may miss out on certain tax benefits. |

Changing Your Amortization Schedule

If you find that you’re struggling to afford your monthly payment, there are options.

A lengthier amortization schedule will spread out the repayment of your loan over a longer time. That will reduce the monthly payment, though you’ll be making payments longer and likely pay more interest. If qualified, you can extend your loan term by refinancing your mortgage or requesting loan modification.

To shorten your amortization schedule and pay off your loan more quickly, you can refinance to a shorter term with a higher monthly payment, or you can make extra payments on your current loan to reduce your balance more quickly.

One common way to do this is by paying half the monthly mortgage payment every other week. Those 26 biweekly payments are equivalent to 13 monthly payments a year. The extra payment reduces the principal of your loan more quickly, which means less interest accrues, and you’ll pay off the loan sooner.

You also could make more than the minimum payment each month, or make extra payments when you can afford to do so.

A potential drawback to repaying your loan early is that some lenders will charge a prepayment penalty to compensate them for the interest you won’t be paying. Make sure you understand if your loan has a prepayment penalty, and how much it is, before deciding to make extra payments. Paying the penalty may make sense if repaying your loan ahead of schedule will save you more in interest.

Accelerated payment example

Here’s an example of how additional payments affect loan amortization.

On a $250,000 loan with a term of 30 years and an interest rate of 6%, the monthly payment is $1,499. Making that payment every month for 360 months will repay the principal and amount to $289,595 in interest charges.

If you paid $1,600 a month on the same loan, the extra $101 would go toward reducing your principal. You would pay off the loan in 25 years and 5 months — 305 payments — instead of 30 years, and you would pay $237,611 in interest, which would save you $51,984.

Amortization FAQ

Here are the answers to some frequently asked questions about amortization.

No. One example is the balloon loan, which requires a large payment at the end of the mortgage term. These loans are riskier for buyers who cannot guarantee future income sufficient to afford the large final payment.

The longest mortgage amortization period is typically 30 years. Tuyo says that there have been offers on the market that extend amortization to 40 years, but those are less common.

“In some cases, there are longer amortization periods, as well as home refinancing options that could extend one’s repayment schedule,” Tuyo says. “But in most cases, borrowers will only encounter loan options of up to 30 years.”

Yes. Anything you pay in addition to your monthly payment is applied to your principal, so paying extra directly reduces the amount you owe. That also decreases the total amount of interest charged, and you’ll pay off the loan more quickly.

If your loan has a prepayment penalty, keep in mind that the lender will charge a fee for paying off your mortgage too early. Be sure to check your loan terms and factor in that fee before making extra payments.

Amortization expenses are generally covered by the total interest charged and the mortgage’s annual percentage rate, which represents the total yearly cost of the loan, including fees. When deciding between different amortization schedules and mortgage lenders, be sure to factor in APR.

The Bottom Line on Amortization

What does amortization mean in a mortgage? It’s the idea that your homeowner dreams can become reality by making consistent monthly payments that pay down interest and principal in varying amounts over time. Your mortgage amortization schedule can help you understand how quickly you’re building equity in your home, as well as how much you’ll be paying in total interest. You could even use amortization to your advantage — by paying off your loan early to save money in the long run.

T.J. Porter contributed to the reporting for this article.