Buying a house is an exciting prospect, but the paperwork involved in applying for a mortgage can seem overwhelming. You’ll need to give your lender what seems like a never-ending stream of documents detailing your income and loan balances.

Knowing what documents you may need and gathering them in advance can make the entire homebuying process easier and less stressful.

Here’s a rundown of the documents you need to apply for a mortgage:

- Completed Mortgage Application

- Signed Purchase Agreement

- Identity Documents

- Income Documents

- Debts and Expenses

- Assets

- Other Documents

- FAQ: Documents Needed for a Mortgage

- The Bottom Line on Documents Needed for a Mortgage

Completed Mortgage Application

Obviously, if you’re applying for a mortgage, the lender will require you to complete a mortgage application.

Most mortgage lenders in the United States use what’s called the Uniform Residential Loan Application. This standardized form is where you’ll provide basic information such as how much you want to borrow, and details about your employment and income. You can review this form online to see what kind of information is required.

Your lender may need you to fill out this form twice — once when you first apply for the loan, and again to accept the final loan terms.

The lender ultimately will require documents to verify the information in your application.

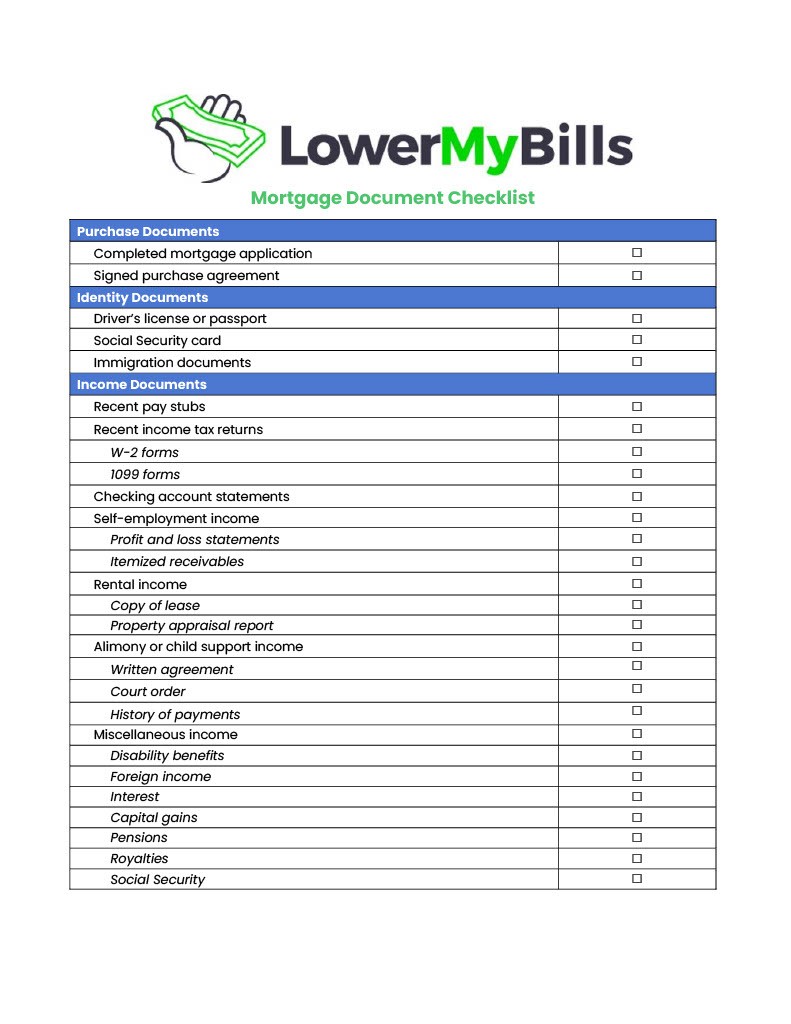

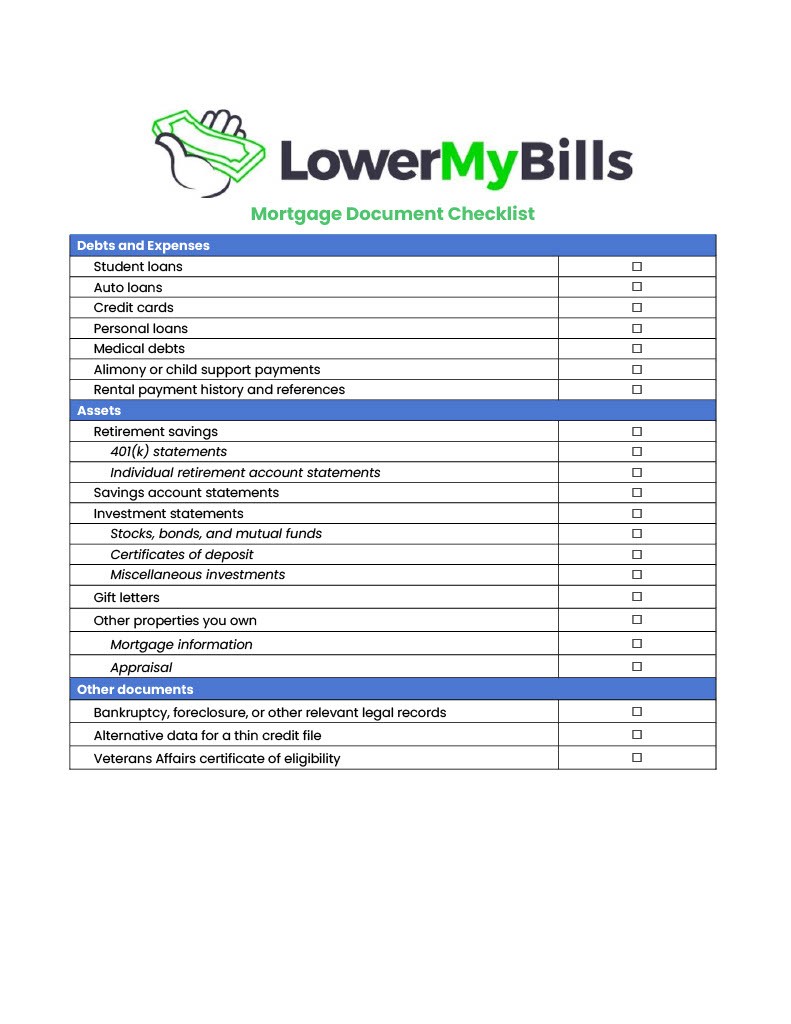

Download our mortgage document checklist

We’ve created this free mortgage document checklist to help you organize your application. You can download the checklist and print it out for your reference as you prepare to apply for a home loan.

Signed Purchase Agreement

While it isn’t strictly required to apply for a mortgage, many lenders will want to see your signed purchase agreement. You typically can get a loan estimate without this agreement, but your final application should include it.

Identity Documents

Before a lender gives you a mortgage, it’ll want to make sure that you are who you say you are.

Driver’s license or passport

A driver’s license or passport are among the most common pieces of identification required to prove your identity.

Social Security card

You need to provide your Social Security number so the lender can check your credit report and credit score. Some lenders will ask to see your actual Social Security card to verify the number.

Immigration documents

If you’re not a U.S. citizen, lenders will want to see a green card, work visa, or similar document that shows your status as a legal resident.

Income Documents

Lenders will verify your income by requesting several documents.

Pay stubs

Pay stubs from your employer show how much you receive with each paycheck, how much is withheld for taxes and other deductions, and your year-to-date earnings.

Income tax returns

Lenders might ask to see your income tax returns to verify your annual income from all sources. They also might ask for supporting tax forms that document your income.

W-2 forms

A W-2 is a form that you receive from each employer every tax year showing all wages, tips, and other compensation, as well as all withholdings.

1099 forms

There are various types of 1099 forms, such as 1099-MISC or 1099-NEC, which detail other sources of income. For example, if you did some work as a contractor or freelancer, won a prize, or receive rent payments, you’ll get a 1099 form that you can provide to your lender.

Checking account statements

Your lender will ask for recent bank statements, which will be reviewed to:

- Confirm reported income and expenses.

- Check for unusual recent activity.

- Document the source of funds for your down payment.

Self-employment income

The unfortunate truth is that it can be more work to get a mortgage for the self-employed than it is for people who work for a company. You’ll have to provide additional mortgage paperwork.

Profit and loss statements

A profit and loss statement details all income and expenses for a business or an individual. This lets your lender see how much money you or your business make in a year, and whether the profits are sufficient for you to afford a mortgage.

Itemized receivables

An itemized list of accounts receivable — invoices for which you’re expecting payment — shows the lender your expected income for the immediate future.

Rental income

If you own rental properties, lenders will want to know if you’re able to cover the cost of those properties with the rent you collect — as well as any profit. If you’re relying on rental profits to afford the mortgage you’re applying for, this becomes even more important.

Documentation of rental income

You can verify rental income with a few different documents, such as your checking account statements or your income tax returns.

Copy of lease

Lenders might ask for copies of the leases or rental agreements you have with your tenants to show how long your tenants are signed up for and how much they’re paying you in rent.

Property appraisal report

An appraisal shows the value of the property that you’re renting out. This helps your lender understand the bottom line on your rental business and its impact on your abilty to afford a new mortgage.

Alimony or child support income

If you receive alimony or child support, you can choose to include that information in your application. If you do so, lenders must consider that income if the payments are likely to be consistently made, based on factors such as:

- A written agreement.

- A court order.

- The history of payments.

- The creditworthiness of the payer.

You also have the option to exclude these payments from your application.

Miscellaneous income

If you earn other income, be prepared to show where it comes from and how long it’s expected to continue.

For example, you might want to show income from sources such as:

- Disability benefits.

- Foreign income.

- Interest.

- Capital gains.

- Pensions.

- Royalties.

- Social Security.

Debts and Expenses

Lenders will want details on your debt obligations and expenses. In most cases, providing copies of your most recent loan or account statements is sufficient.

Student loans

If you have student loans, you’ll need to show how much you owe and your current monthly payment. If you’re on an income-driven repayment plan, lenders will consider your actual loan payment when making a lending decision. If you’re in deferment or forbearance, lenders will calculate your payment as either 1% of the balance or by amortizing it according to the documented terms.

Auto loans

If you have an auto loan with more than 10 payments remaining, lenders will consider that as part of your monthly obligations. If there are 10 or fewer payments remaining, lenders will only consider the payment if it has a significant impact on your ability to afford the mortgage.

Credit cards

Lenders will treat the balance of credit cards and unsecured lines of credit as long-term debts, and the minimum required payments will be included in your total monthly debt obligation, which affects your debt-to-income ratio. Among the documents needed for a home loan are statements that show your minimum monthly payment, especially if you have a large balance.

Personal loans

Lenders consider personal loans with more than 10 payments remaining as part of your monthly obligations. Loans with a shorter remaining term only play a role if they have a noticeable effect on your ability to handle your obligations.

Medical debts

Lenders are allowed to consider outstanding medical debts when making a lending decision. However, they may not consider medical debt differently from other types of debt, such as a personal loan, or use the assumption that you have a medical condition as a basis for denying your application.

Alimony or child support payments

If you’re required to pay alimony or child support, you’ll have to provide the court order, divorce decree, or similar documents detailing the payments.

Rental payment history and references

Your lender might ask for proof of rental payments to your most recent landlords. You can prove this by providing:

- Canceled checks.

- Bank statements showing timely payments.

- Direct verification from your landlords.

Assets

Financial assets show lenders that you have the resources to afford a home loan.

Retirement savings

Even if you don’t plan to use any of your retirement savings for your down payment or to pay for your loan, lenders may ask how much you’ve saved up.

401(k) statements

401(k)s are employer-sponsored retirement accounts. You can provide statements showing the balance and any remaining vesting time, if you aren’t yet vested in the plan.

Individual retirement account statements

If you have an IRA, you can provide a statement showing your current account balance.

Savings account statements

You can use money in a savings account for expenses such as your down payment and closing costs. Your most recent statements usually are sufficient to show these funds.

Investment statements

If you have money in a brokerage account or other investments, accounting for those funds shows lenders that you have resources to help repay the loan.

Stocks, bonds, and mutual funds

A statement showing your current account balance, investment positions, and recent transactions will show your lender proof of funds from invested assets.

Certificates of deposit

CDs are less liquid than other assets, but you can use a recent statement to show your lender the account balance and when the funds will become available.

Miscellaneous investments

If you have other liquid assets that you want to use as proof of adequate reserves, you’ll have to provide documentation showing their value to the lender.

Gift letters

If you receive a cash gift to help you with your down payment or closing costs, your lender will ask for a gift letter. This letter should detail the amount of money you’re receiving and the source of the funds, and provide assurance that the money is a gift instead of a loan that’s expected to be repaid.

For some types of loans, you may only receive gifts from family members, charities, your employer, or a union.

Other properties you own

If you own other property, lenders will want details about those properties when underwriting a new mortgage.

Mortgage information

First, your lender will want to see the details of the outstanding mortgage on your other property, if applicable. Your most recent statement will show the monthly payment, interest rate, and remaining balance.

Appraisal

Many lenders will ask for an appraisal of any property you own that is currently mortgaged.

Other Documents

Depending on your situation and the type of loan you’re applying for, lenders might request additional documents.

Bankruptcy, foreclosure, or other relevant legal records

If you’ve gone through bankruptcy, foreclosure, or another legal judgment that relates to your finances or debts, it can be difficult to get a mortgage.

Lenders will, at a minimum, want to make sure that any bankruptcy has been discharged and foreclosure completed. They also prefer you to have spent some time rebuilding your credit before applying for a mortgage.

“For those with a particularly tough financial history, including things like bankruptcy or foreclosure, it can be helpful to add an explanatory note to your mortgage application outlining the circumstances around your financial struggles and explaining why and how you’re less of a financial risk than your history may indicate,” says Martin Orefice, CEO of Rent To Own Labs, an Orlando, Florida-based real estate company. “Concrete guarantees like a larger down payment or a co-signer on your mortgage are going to do a lot more than these kinds of notes, but more context can be a great help to lenders in deciding whether to take on risky cases.”

Alternative data for a thin credit file

If you have a thin credit file — meaning you’ve had limited interactions with credit — lenders will look for other ways to verify your ability to pay your debts.

“To boost a thin credit file, be sure to bring proof of utility bills and rent or car payments you have been making for the past several months up to two years,” says Melanie Hartmann, owner of Creo Home Buyers, a Timonium, Maryland-based real estate firm. “This documentation will show the mortgage company that you have a long and consistent history of making large monthly payments, and that you may be a good candidate to pay off a mortgage.”

VA certificate of eligibility

If you’re applying for a VA loan, you’ll need a certificate of eligibility to prove that you’re an active military service member, veteran, or the spouse of one. You can request a certificate of eligibility from the Department of Veterans Affairs. Other programs with limited eligibility may require similar documentation.

FAQ: Documents Needed for a Mortgage

While it can feel overwhelming to deal with so much mortgage paperwork, there are a few things you can do to make the process easier.

Many lenders will ask you to submit your loan documents online. While you can scan physical copies of your documents, it’s likely easier to visit your accounts online and download digital copies of your statements and pay stubs. Most lenders use a secure online file transfer system to accept digital documents.

Having negative information, such as collections or missed payments, on your credit history can make it harder to get a loan. However, if you provide a letter of explanation, this could help your chances. The letter should detail what happened to cause that negative information to appear on your report, and include any documents you can provide to support your explanation.

The Bottom Line on Documents Needed for a Mortgage

When you apply for a mortgage, you’ll need to gather a lot of documentation. Our mortgage checklist can help you understand exactly what details you’ll need to provide to your lender when you submit your final application.