Since refinancing your home involves taking out a new mortgage, the application process will be similar to what you experienced when you got your current loan. You need once again to document your finances thoroughly for your lender, which means a lot of paperwork.

It helps to know what documents you need for refinancing so you can gather them in advance. Here’s what you need to know, as well as a document checklist for refinancing a mortgage.

Key Takeaways:

- Refinancing your home involves applying for a new loan, so your lender will require documents that show your finances. Having these documents ready before you apply can expedite the process.

- Most lenders require copies of your pay stubs, W-2 or 1099 forms, and recent income tax returns. They also will run your credit and look at all your debts, including student loans, car loans, and credit cards.

- Expect to provide current statements for your investments, as well as for your checking and savings accounts.

Documents Needed To Refinance a Home

When you apply to refinance your home, your lender needs to document and review your finances. There’s a certain amount of risk that the lender you choose takes on when approving you for a loan. Your lender needs to be sure you can afford to repay the loan before approving your application.

Gathering documents ahead of time can make refinancing your mortgage go more smoothly.

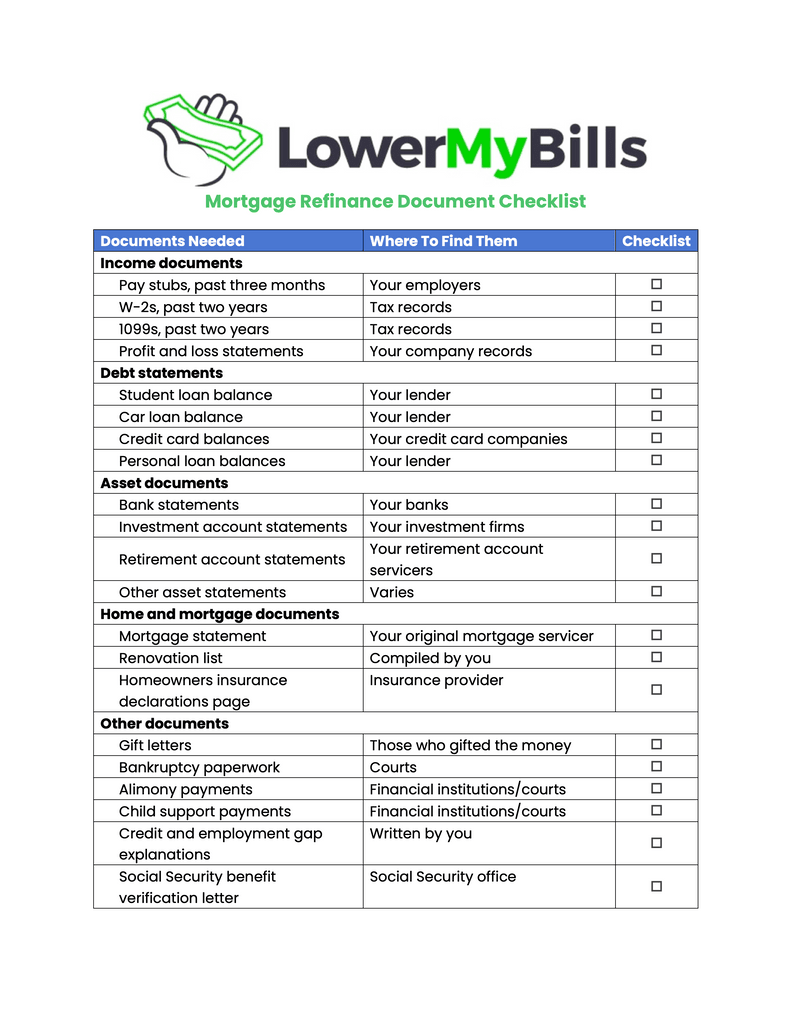

Quick access: Download our refinance checklist

We’ve created this free mortgage refinance checklist to help you keep track of your documents. You can download the checklist and print it out for your reference as you prepare to refinance your home.

Note that different types of loans may require additional documents. For example, Veterans Affairs loans — including refinances — require borrowers to have a certificate of eligibility that shows their military service qualifies them for this benefit. Ask your lender exactly what documents you need to provide.

Pay stubs and income verification

Your lender needs to see proof of income to verify that you can afford your new loan. You’ll typically be asked for your most recent pay stubs, covering the last month or two. If you own the home with a partner, this applies to both of you.

If you are self-employed or own a business, you need to submit a profit and loss statement and your two most recent income tax returns.

If you have additional income outside of your primary job — say you own a business or investment property — then you’ll want to document those earnings to ensure your lender includes them in your debt-to-income ratio. You can figure out where you stand with the LowerMyBills DTI ratio calculator.

Income tax returns, W-2s, and 1099s

Whether you’re a salaried employee or a freelancer, your W-2, 1099, and income tax forms document your income and help your lender decide if you can afford your new monthly mortgage payment. You’ll typically be asked to submit documents that cover the past two years.

Debt statements

Your lender will want a list of your debts, including how much you owe and how you’re repaying them. Be prepared to provide statements for student loans, credit cards, personal loans, and car loans. In addition, be ready to provide the most recent statements from your current mortgage.

Credit verification

Your lender needs permission to check your credit. If you’re refinancing a conventional loan, you typically need a credit score of at least 620. Government-backed mortgages — such as Federal Housing Administration loans, U.S. Department of Agriculture loans, and VA loans — have varying minimum credit requirements, as do the lenders that offer those loans.

Your lender will need your Social Security number to check your credit. If you have any red flags in your credit history, like a bankruptcy, you will want to provide additional documents that explain the circumstances or show the issues have been resolved.

Asset statements

While pay stubs and tax returns show how much money you’ve earned recently, asset statements show how much overall wealth you have. Be prepared to provide recent statements from your checking, savings, retirement, and investment accounts.

Assets can be liquid or nonliquid. Liquid assets include cash or things that can be quickly converted to cash, such as the balance of your checking and savings accounts. Nonliquid assets take longer to convert to cash, and include items such as jewelry, furniture, art, or cars.

A list of assets can show your lender that you’ll be able to afford the cost to refinance a mortgage and to continue to pay your loan even if there’s an unexpected interruption in your income.

Proof of homeowners insurance

Homeowners insurance covers both the home and the items inside of it in the event of a fire, hurricane, or other type of disaster.

If a disaster struck and you had no homeowners insurance, it would jeopardize your ability to pay your mortgage. So, lenders require homeowners insurance for all borrowers and will ask to see a copy of your policy as proof that you have enough coverage.

Damage caused by floods and earthquakes is excluded from standard homeowners insurance policies, so you may need additional coverage if you live in an area where they are likely to occur.

Other documents

Your lender may ask for additional documents, such as:

- Gift letters that explain any recent large deposits from friends or relatives.

- Explanation letters regarding employment gaps, credit changes, or other anomalies.

- Alimony or child support payment information if you’re divorced or separated.

- Bankruptcy paperwork, if applicable.

- A Social Security benefit verification letter if your income is supplemented by Social Security.

What Do I Need To Refinance My Home?

Having the right documents available is just one step in refinancing your mortgage. You also need to get the mortgage you’re applying for.

The approval requirements will depend on the type of loan you’re applying for, and each lender can have its own requirements.

Eligibility Requirements for Common Mortgage Refinance Loans

| Loan Type | Minimum Credit Score | Maximum DTI Ratio | Income Verification | Appraisal | Notes |

| Conforming conventional loan | 620 | 50% | Yes | Yes | Loans cannot exceed $726,200 in most areas, and $1,089,300 in high-cost areas. |

| Nonconforming conventional or jumbo loan | 680 | 45% | Yes | Yes | Loans exceed conforming loan amounts; usually $1 million to $2 million. |

| FHA loan | 500 for a rate-and-term refinance; 580 for a cash-out refinance. | Varies | Yes | Yes | No need to have a current FHA loan to refinance into one. |

| FHA streamline refinance | 580 | Varies | No | No | Must have an FHA loan, and the new loan must meet the net tangible benefit requirement. |

| VA loan | 580 | 45%-60% | Yes | Yes | Must be eligible for VA loans. |

| VA interest rate reduction refinance loan | 580 | 45%-60% | No | No | Must have VA loan and be able to lower interest rate. |

| USDA refinance | No requirement, but 640 is suggested. | 41% | Yes | Yes | Must meet income and property requirements. |

| USDA streamlined-assist refinance loan | Not required. | Not required. | No | No | Must have USDA loan. |

| USDA standard streamlined refinance | 640 | 41% | Yes | No | Must have USDA loan. |

Are You Ready To Refinance?

Here are some factors you should take into account as you consider why you should refinance your home:

- Income. If your earnings have increased substantially since you bought your home, and you can afford a higher monthly payment, then you could refinance to shorten your loan term and pay less interest. However, if you’re having trouble affording your mortgage, then you may want to refinance to lower your monthly payment with a longer loan term, though this will cost you more in overall interest.

- Closing costs. According to Freddie Mac, closing costs on a refinance are about $5,000 on average. Keep in mind that there could be other refinancing expenses, such as private mortgage insurance if your home equity dips below 20% after you refinance.

- Time spent in the home. If you plan on staying in your home, then you’ll likely have enough time to recoup the costs of refinancing through your savings on interest. However, the sooner you sell your home, the less you might be able to save.

- Prepayment penalty. Some lenders charge a prepayment penalty if you pay off your mortgage too soon. Before you refinance, see if your current mortgage comes with this type of penalty.

- Interest rates. If mortgage interest rates have dipped, then refinancing may be an opportunity to save money. However, if rates are the same or have risen since you took out your original mortgage, you could lose money and end up with a higher monthly payment.

FAQ: Documents Needed To Refinance Your Home

Here are answers to some common questions about the documents needed to refinance your home.

Depending on your situation and the type of loan you choose, it typically takes between 30 and 45 days to refinance your mortgage.

You can refinance as often as you’d like. However, some lenders require you to wait a certain amount of time — typically six months — after a refinance before you can do it again. You also need to maintain a certain amount of equity in your home to refinance, and you have to pay closing costs when you refinance. This will make it more difficult and expensive to refinance your mortgage without sufficient time passing for you to recoup your costs with a lower payment or interest rate.

A cash-out refinance lets you take out a new loan that’s larger than the payoff amount for your current loan and keep the difference. You repay that amount as part of your new loan. Some programs, such as an FHA streamline refinance, won’t let you take cash out or have limits on the amount of equity you can borrow.

The Bottom Line on Documents Needed for Refinancing

Refinancing your mortgage requires you to document your finances in full so your lender can evaluate whether you can afford your new loan. By preparing ahead of time, you can expedite the process and put yourself in a better position to get approved. Make sure to also ask your lender any questions you have about your refinance checklist — and then you can be on your way to getting a new loan.

T.J. Porter contributed to the reporting of this article.