A reverse mortgage lets older homeowners borrow the equity they’ve built in their home to pay expenses or supplement their income while continuing to live in it. Instead of the borrower making payments to the lender and reducing their loan balance, the lender pays the borrower, and the loan balance grows.

Reverse mortgages are a specialized financial product, and their terms can be complicated. It’s important to understand how reverse mortgages work — and their financial implications — before getting one.

If you’ve explored your options and decided to apply for a reverse mortgage, gathering the reverse mortgage documents you’ll need in advance can make the process simpler and easier.

Key Takeaways:

- A reverse mortgage is a complicated financial product that requires specific documents from potential borrowers, including a counseling certificate.

- As with most loans, you’ll need to document your finances, including your income, debts, and expenses.

- Using a checklist to gather your documents in advance can make the process of applying for and closing on a reverse mortgage easier and quicker.

What Documents Do You Need For a Reverse Mortgage?

Like any major financial transaction, applying for a reverse mortgage requires a lot of documentation. Your mortgage lender will want a full understanding of your finances, as well as information about your home. You’ll need to gather documents related to your home, personal identification, bank and investment accounts, proof of income, and more.

Reverse mortgage application

The first reverse mortgage document that you’ll need is the application itself. Each reverse mortgage lender will provide an application, and can assist you in filling it out.

A typical application asks for information about the property, identification for the property owners, a list of income and assets, and details on any liens on the property. The Department of Housing and Urban Development includes a reverse mortgage application among its sample reverse mortgage documents to give you an idea of what to expect.

Credit check authorization

To make sure you are a reliable borrower, lenders will check your credit. Borrowers with a higher credit score are more likely to be offered favorable terms, such as a lower interest rate.

Reverse mortgage counseling certificate

Anyone considering a reverse mortgage must meet with a counselor approved by HUD. The counselor will explain how reverse mortgages work, and outline alternatives to getting a reverse mortgage. The counselor also will review your finances, and offer guidance and resources to help you decide which option is best for you.

You may have to pay an upfront fee for the counseling session. People whose income is below 200% of the federal poverty line, or who are facing financial hardship, may be able to delay this payment until their reverse mortgage closes.

Once you complete counseling, you’ll receive a certificate that lenders will require to approve you for a reverse mortgage.

Home documents

Because your home serves as collateral and properties must meet eligibility requirements for a reverse mortgage, lenders will want to review documents related to your home.

Some of these documents might not apply to your situation, or may be optional with some lenders. Either way, it should be helpful to gather your reverse mortgage documents in advance to make the application process go more smoothly.

Deed or title

A deed is a document that proves the legal transfer of ownership of a property, and is signed by both the seller and buyer at the time of the sale. A title is a legal record of a property that includes a physical description and an ownership history. Lenders will ask to see either document, or both, to confirm your ownership of the home.

Current mortgage statements

If you’re still paying off a mortgage on your home, you will need to provide the lender with documents showing how much you owe on it. Typically, your monthly mortgage statement will show all the relevant details, including your current loan balance.

This is important because it affects how much equity you have, which in turn affects how much you can borrow with a reverse mortgage. Home equity is the difference between what a home is worth and how much the owner owes on it. Lenders typically require borrowers to use the funds from a reverse mortgage to completely pay off any outstanding mortgages. If you still owe money on a mortgage, you’ll have to pay it off with your reverse mortgage funds, which will reduce your equity and the amount you can borrow.

Home equity loan or HELOC statements

Home equity loans and home equity lines of credit also affect the amount of equity you have in your home, so lenders will want to know how much you owe on any such loans. Again, your monthly statement should include the relevant details, including your loan balance.

Proof of satisfaction of mortgage

If you’ve paid off your mortgage, you should have a document from your lender that proves the loan has been satisfied. It should include your name, the location of the property, and the date you paid the loan off. Effectively, it shows that you own your home free and clear.

Property tax statements and receipts

You must pay your property taxes as a condition of a reverse mortgage. Failure to do so can result in liens being placed on your home, or the government taking possession of your property. You’ll need documents showing lenders that you’re current on your taxes. You usually can show a recent tax bill to prove you owe no back taxes. You also might need a receipt showing payment of the most recent bill.

Homeowners insurance policy and statements

Another responsibility of a reverse mortgage borrower is to properly insure the home. Lenders will want to see your homeowners insurance documents to be sure you are sufficiently covered and your policy is paid up. Your insurance documents should note the address of the home and detail the types of coverages and any applicable limits you have.

Home maintenance documentation

Because your home is collateral for the loan, lenders want to make sure the property maintains its value. You need to keep your home in good condition, so any documents you can provide related to the upkeep and maintenance of your home may help your application.

Proof of occupancy

You can get a reverse mortgage only for your principal residence, and the loan must be repaid as soon as you no longer live in the home. You can prove the home is your primary residence using documents such as utility bills, state-issued identification, motor vehicle registrations, court documents, or a public official’s statement.

HOA documentation

If you live in a community with a homeowners association, you’ll need a copy of its rules stating the required dues. Reverse mortgage borrowers are responsible for paying their HOA dues, so your lender may ask for recent statements and proof of payment.

Home survey documents

Your lender may ask for any survey documents you have, to ensure your property can serve as adequate collateral for the loan. A home survey examines your property to make sure that the information on the title or deed is accurate. A survey often includes a description of the property and may include a map or diagram. Inaccuracies can mean that you own less property than expected, or could result in other issues that affect the value of your real estate.

Personal identification

As with any loan application, you’ll need to provide personal identification. The lender uses this information to check your credit, and make sure you’re a good candidate for a loan.

Driver’s license

A driver’s license is a common piece of identification that lenders can use to confirm your identity and age. The latter is important because reverse mortgages are available only to homeowners 62 or older.

Social Security card

Your lender may ask for your Social Security card, or more likely just for your Social Security number. This lets the lender confirm your identity and check your credit report.

Other ID documents

If you lack a driver’s license, lenders might ask for a birth certificate, a passport, or some other document that verifies your identity.

Proof of income

A reverse mortgage is a loan, so lenders will review your finances before approving you for a reverse mortgage — even though there’s no income requirement. This includes proof of all your sources of income, such as job earnings, retirement benefits, Social Security income, and investments.

Social Security awards letter

The Social Security Administration issues benefit verification letters that show how much your monthly benefit is.

401(k) account statements

Your 401(k) statements show your account balance, and how the money is invested. If you’re relying on your 401(k) for retirement income, your lender will want to confirm the balance provides sufficient income.

Pension plan statements

If you have a pension, you should get regular statements that outline how much you receive each month.

Recent income tax returns

Your tax returns list all your income and deductible expenses, providing a handy annual snapshot of your finances.

Recent W-2s or 1099s

If you’re working, your employers will give you tax documents — like W-2s and 1099s — that show your income.

Assets

To give your lender a complete picture of your finances, you also will have to provide statements and other documents that show how much you have saved, and the value of any assets you own, such as annuities, property, stocks, and other investments.

Bank statements

Your bank statements show both the balance of your bank accounts as well as your transaction history. This lets lenders check how much money you have set aside, and identify any unusual spending habits or income that could affect your ability to qualify for a loan.

Savings

Most lenders will ask for statements that show how much money you have saved. The more savings you have, the easier it will be for you to meet the conditions of a loan, and the more resilient you can be when faced with unexpected expenses.

Stocks and other investments

The more investments you own, the more financial resources you have to pay your expenses. This includes stocks, bonds, mutual funds, real estate, or anything else you’ve invested in. Brokerage and retirement account statements usually show lenders the information they need.

Annuities

An annuity is an insurance product that provides regular payments for people to use as a source of income. If you’re relying on an annuity, then provide documents that show how much you will receive and when.

Proof of financial hardship

To get a reverse mortgage, you need to complete reverse mortgage counseling. Counseling costs money, but if you can prove financial hardship, then you could delay paying for it until after your reverse mortgage is approved. If you need to delay the fee, the following documents may be necessary.

Medical documentation

Medical issues are a common source of financial hardship. If you’re able to provide medical bills or documentation from a doctor showing you have health issues that make it difficult for you to earn a living, this can help you prove financial hardship.

Statements for unpaid accounts

If you have utility or credit card bills that you’re unable to pay, you can show the statements to your lender to help prove financial hardship.

Budget showing current expenses

Another way to display financial hardship is to produce a budget of your current income and expenses. This can help lenders put your financial situation in perspective.

Legal documents

To get a reverse mortgage, you must use the home as a primary residence. When you no longer live in the home, you need to repay the balance. This can get complicated for older people. Medical issues may force you to move out of your home, or you could die with a surviving spouse still living in the home.

This documentation is only necessary if these situations apply to you.

Spouse’s death certificate

If you get a reverse mortgage while married, your spouse may be able to continue living in your home after you die — even if they aren’t a co-borrower on the loan.

A death certificate will prove to the lender that the borrower or their spouse has died instead of having moved out. Moving out would initiate repayment of the loan.

Durable power of attorney documentation

A person who is not legally competent cannot sign legal documents, meaning they can’t get a reverse mortgage. If you have power of attorney for a loved one, you’ll need to show the documents to prove that you have the right to sign on their behalf for a reverse mortgage.

Conservatorship documents

Similar to a power of attorney, if you’re serving as conservator for someone, you’ll need to prove that you have the right to sign on their behalf for a reverse mortgage.

Trust agreement

If a property is held in trust, you’ll have to provide documents outlining the terms of the trust before you can qualify for a reverse mortgage.

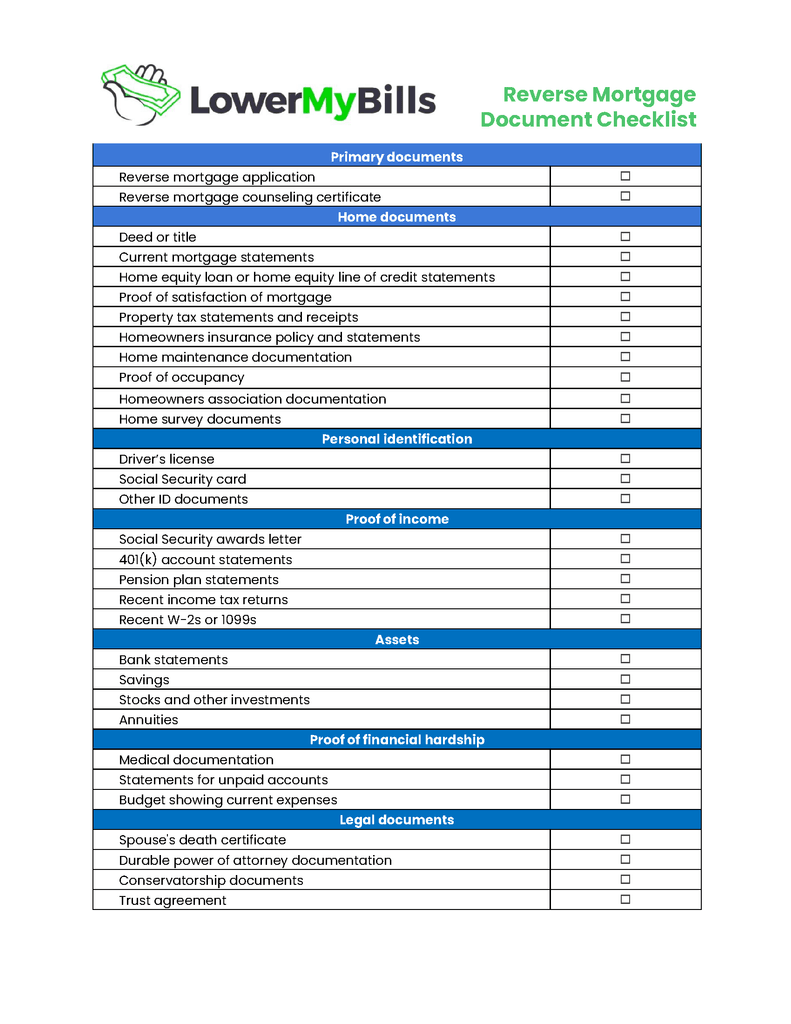

Reverse Mortgage Document Checklist

Reverse mortgages are highly complex financial agreements, and it helps to have your documents at the ready when you apply. Use this reverse mortgage document checklist when you gather all your documentation.

When Are Reverse Mortgage Documents Required During the Application Process?

When you apply, it helps to have your reverse mortgage documents ready. If you can provide more information upfront, it will make the lending process go more smoothly.

Reverse mortgage documents timeline

In an ideal situation, you’ll have all of the necessary documents ready before you start applying for a reverse mortgage. However, that isn’t always the case.

At a minimum, to start the process, you’ll need to get a counseling certificate and some basic home documents, like your deed, and mortgage statements or proof of satisfaction of your mortgage. You can continue gathering the other required documents as the lender asks for them.

The process from applying to closing on the loan can take about 30 to 45 days.

Closing On a Reverse Mortgage

Closing on a reverse mortgage is similar to closing on the purchase of a home with a typical mortgage.

After you submit your application, the lender will process the loan during underwriting. That involves reviewing the details you’ve provided and asking for clarification, if needed. The lender also will order a home appraisal.

Once your loan is approved, you’ll be ready to close. That means sitting down with a professional and signing a lot of reverse mortgage closing documents. You should review the documents to make sure the terms are correct, including the amount and frequency of payments you’ll receive, the interest rate, and the fees you’ll pay.

The loan’s fees often get rolled into the balance to prevent the borrower from having to pay closing costs out of pocket.

Documents to sign at closing on a reverse mortgage

HUD has a list of more than 20 documents that need to be signed for a home equity conversion mortgage, including:

- Choice of insurance option.

- Inspection report.

- Appraisal report.

- Eligibility documents.

- Evidence of the mortgagor’s age.

- Evidence of mortgagor’s Social Security number.

- HECM financial assessment worksheets.

- Mortgage documents.

FAQ: Reverse Mortgage Documents

These are answers to some frequently asked questions about required reverse mortgage forms.

If you get a reverse mortgage, you keep the title and deed as long as you live in the home. You remain responsible for the upkeep of the home, and paying for property taxes and homeowners insurance.

Anyone asking or requiring you to transfer the deed to a third party is a red flag for fraud, says Steve Hill, a mortgage broker with SBC Lending in Fullerton, California.

“In general, you don’t get anything for free,” he says. “If it sounds too good to be true, it probably is — and never transfer title for your home to someone else.”

Most reverse mortgages are insured by HUD. In those cases, one deed of trust is held by the lender, and another by HUD because it provides insurance for the lender.

Yes. Lenders must provide reverse mortgage closing documents that outline the terms of the loan and the fees.

The Bottom Line on Reverse Mortgage Documents

Reverse mortgages are complex, but in the right circumstances, they can help older homeowners supplement their income so they can afford to continue living in their homes. If you think that a reverse mortgage is right for you, try to gather all the required documents before applying. Having the information ready for your lender can speed up the lending process.